IC Markets, as a veteran platform, enjoys a good reputation for providing a safe and reliable trading platform.

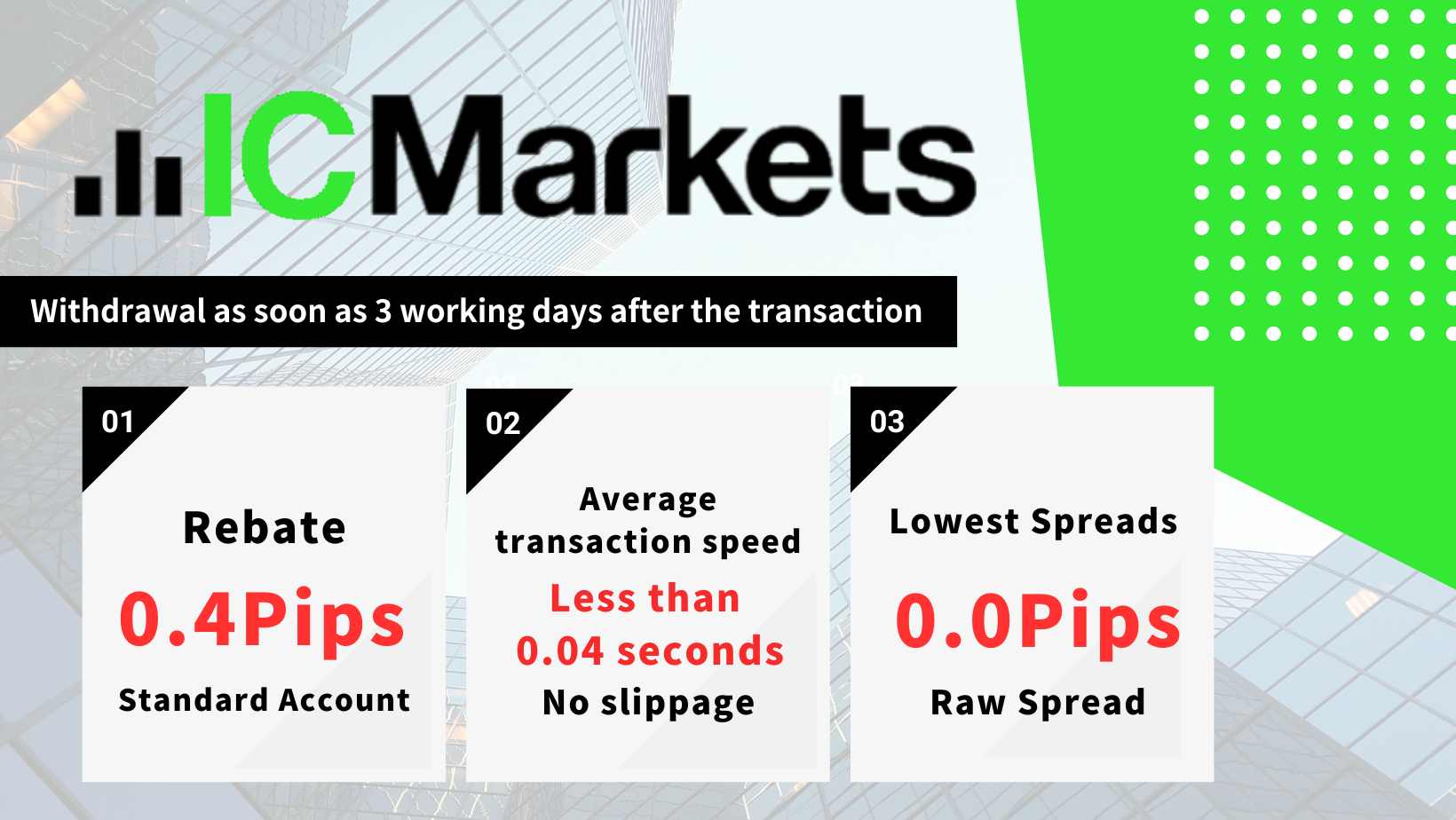

The richness of trading commodities, spreads starting from as low as 0.0 pips, coupled with a stable and non-slippery trading environment as well as a perfect fund management system, are all great attractions of IC Markets.

IC Markets Corporate Information

Since its establishment in 2007, IC Markets has obtained permission from the Australian Securities and Investments Commission and an AFSL license to provide services.

| Registered Name | Raw Trading Ltd |

|---|---|

| Year of Establishment | 2007 |

| Registered Address | office number 222,1st Floor, Eden Plaza, Eden Island Seychelles |

| Financial License | The Financial Services Authority of Seychelles(FSA):SD018 |

| Zero Balance | Automatic Clearance System |

| Max Leverage | 1000 |

| Customer Service | Telephone, mail, and real-time text customer service

|

In addition to the financial license of Cyprus, IC Markets has also obtained the financial licenses of the following entities.

Among them, the financial licenses of Cyprus and Australia are well known for their difficulty in obtaining them, and their level of trust is unimpeachable.

| Trade Name | Regulator | License Number |

|---|---|---|

| International Capital Markets Pty Ltd | Australian Securities & Investments Commission(ASIC) | 335692 |

| IC Markets (EU) | Cyprus Securities and Exchange Commission(CySEC) | 356877/362 |

| IC Markets Ltd | Securities Commission of The Bahamas(SCB) | SIA-F214 |

IC Markets Features and Trading Environment

The main features of IC Markets are as follows.

- The main features of IC Markets are as follows.

- Leverage up to 1000x

- Low spreads from as low as 0 pips

- Average execution speed less than 0.04 seconds

- Abundant trading commodities with over 2,000 products

- Diverse platforms

- Negative balance protection system

IC Markets Account Types

IC Markets have three types of accounts.

IC Markets has three types of accounts.

The Standard account, which is the most popular among most traders, has the commission included in the spread, while the Raw Spread and cTrader accounts have a separate commission due to the small spreads.

For MT4 and MT5 accounts, fees are calculated on a per lot basis, whereas for cTrader accounts, fees are calculated on every open and close of a trade.

In addition, either account type can be set up as a swap-free Islamic account.

If you would like to familiarize yourself with the IC Markets trading environment before opening a trading account, we recommend opening a demo account.

| Account Type | Standard Account | Raw Spread Account | cTrader Account |

|---|---|---|---|

| Base currency | USD、EUR、JPY、AUD、CAD、CHF、GBP、HKD、NZD、SGD | ||

| Trading Platforms | MT4、MT5、WebTrader (Windows、Mac、Android、iOS) | cTrader、cTraderWeb (Windows、Mac、Android、iOS) | |

| Products | Forex, Indices, Commodities, Precious Metals, Energy, Cryptocurrencies, Stocks, Bonds | ||

| Minimum Spreads | 0.6pips | 0.0pips | |

| Comission | None | 6USD※ | 6USD |

| Max Leverage | 1000 | ||

| Minimum Lot | 0.01Lot(1000 Currency) | ||

| Max Lot | 200 | 2000 | |

| Margin Call | 100% | ||

| Forced Liqudation | 50% | ||

※7USD、7AUD、7CAD、6.6CHF、5.5EUR、5GBP、54.25HKD、9NZD、9SGD

Maximum leverage is 1000x

IC Markets will increase the maximum leverage from 500x to 1000x for all accounts from March 30, 2023 on wards.

A leverage of 1,000x is a top level of leverage even in the world.

Unlike common brokers on the market, IC Markets’ leverage is not affected by the amount of margin in effect in the account or the proximity of a major indicator release, making it very convenient for currency traders or those who trade large volumes.

Spreads on Forex Commodities

IC Markets has a wide range of 61 currency pairs that are popular with individual investors.

A few values are available for reference: USDJPY spreads are 1.0 pips for Standard accounts and 0.2 pips for Raw Spread accounts.

The SWAPs are not published on the official website and traders are advised to check the actual values on the trading platforms themselves.

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDSGD |

| AUDUSD | CADCHF | CADJPY | CHFJPY | CHFSGD |

| EURAUD | EURCAD | EURCHF | EURDKK | EURGBP |

| EURHKD | EURJPY | EURNOK | EURNZD | EURPLN |

| EURSEK | EURSGD | EURTRY | EURUSD | EURZAR |

| GBPAUD | GBPCAD | GBPCHF | GBPDKK | GBPJPY |

| GBPNOK | GBPNZD | GBPSEK | GBPSGD | GBPTRY |

| GBPUSD | NOKJPY | NOKSEK | NZDCAD | NZDCHF |

| NZDJPY | NZDUSD | SEKJPY | SGDJPY | USDCAD |

| USDCHF | USDCNH | USDCZK | USDDKK | USDHKD |

| USDHUF | USDJPY | USDMXN | USDNOK | USDPLN |

| USDRUB※ | USDSEK | USDSGD | USDTHB | USDTRY |

| USDZAR |

※Trading is currently suspended

About the CFD commodities offered

In addition to forex, IC Markets also offers a wide range of commodities such as indices, commodities, precious metals, energy, cryptocurrencies, stocks, bonds, etc. All of these commodities can be traded on the same trading platform as forex.

All of these commodities can be traded on the same trading platform as forex, which is a major advantage of being able to utilize the same capital for all types of transactions.

Indices

Indices include the following 23 categories, including futures such as DXY (ICE Dollar Index Futures) and VIX (CBOE VIX Index Futures).

Maximum leverage is 200x.

| Products | Description | Average Spread |

|---|---|---|

| AUS200 | Australia S&P ASX 200 Index | 1.22 |

| DE40 | Germany 40 Index | 1.338 |

| F40 | France 40 Index | 0.749 |

| JP225 | Japan 225 Index | 8.858 |

| STOXX50 | EU Stocks 50 Index | 1.76 |

| UK100 | UK 100 Index | 2.133 |

| US30 | US Wall Street 30 Index | 1.411 |

| US500 | US SPX 500 Index | 0.492 |

| USTEC | US Tech 100 Index | 1.807 |

| CA60 | Canada 60 Index | 0.6 |

| CHINA50 | FTSE China A50 Index | 6.953 |

| CHINAH | Hong Kong China H-shares Index | 2.083 |

| ES35 | Spain 35 Index | 4.426 |

| HK50 | Hong Kong 50 Index | 8.169 |

| IT40 | Italy 40 Index | 9 |

| MidDE50 | Germany Mid 50 Index | 27.864 |

| NETH25 | Netherlands 25 Index | 0.19 |

| NOR25 | Norway 25 Index | 0.68 |

| SA40 | South Africa 40 Index | 15.444 |

| SE30 | Sweden 30 | 0.38 |

| SWI20 | Switzerland 20 Index | 3.5 |

| TecDE30 | Germany Tech 30 Index | 3.172 |

| US2000 | US Small Cap 2000 Index | 0.48 |

Commodities

The following 8 commodities are available for trading in bulk.

| Products | Description | Average Spread |

|---|---|---|

| Cocoa | Cocoa futures | 4.608 |

| Coffee | Coffee Futures | 0.3 |

| Corn | Corn Futures | 0.68 |

| Cotton | Cotton Futures | 0.15 |

| OJ | Orange Juice Futures | 1.12 |

| Soybean | Soybean Futures | 1.35 |

| Sugar | Sugar Futures | 0.033 |

| Wheat | Wheat Futures | 0.75 |

Precious Metals

Precious metals are available for trading in the following 11 commodities.

| Products | Description | Average Spread |

|---|---|---|

| XAGAUD | Silver vs Aus | 1.4 |

| XAGEUR | Silver vs Euro | 1.813 |

| XAGUSD | Silver vs United States Dollar | 1.894 |

| XAUAUD | Gold vs Aus | 4.679 |

| XAUCHF | Gold vs Swiss Franc | 3.9 |

| XAUEUR | Gold vs Euro | 4.537 |

| XAUGBP | Gold vs GBP | 2.0 |

| XAUUSD | Gold vs United States Dollar | 2.083 |

| XAUJPY | Gold vs Japanese yen | 29.0 |

| XPDUSD | Palladium vs United States Dollar | 163.735 |

| XPTUSD | Platinum vs United States Dollar | 43.3 |

Energy

Energy has the following 5 commodities available for trading.

| Products | Description | Average Spread |

|---|---|---|

| BRENT | Brent Crude Oil Futures | 0.028 |

| WTI | West Texas Intermediate – Crude Oil Futures | 0.027 |

| XBRUSD | Brent Crude Oil Spot vs United States Dollar | 0.034 |

| XNGUSD | Natural Gas Spot vs United States Dollar | 0.004 |

| XTIUSD | WTI Crude Oil Spot vs United States Dollar | 0.034 |

Cryptocurrency

Cryptocurrencies include Bitcoin, Ether, Ripple and 21 other popular commodities for trading.

Leverage is 200x for MT4 and MT5, and 5x for cTrader.

| Products | Description | Average Spread |

|---|---|---|

| ADAUSD | Cardano vs United States Dollar CFD | 0.003 |

| AVXUSD | Avalanche vs USD | 0.067 |

| BCHUSD | Bitcoin Cash vs United States Dollar CFD | 5.839 |

| BNBUSD | Binance Smartchain vs United States Dollar CFD | 1.415 |

| BTCUSD | Bitcoin vs United States Dollar CFD | 42.036 |

| DOGUSD | Doge vs United States Dollar CFD | 0.001 |

| DOTUSD | Polkadot vs United States Dollar CFD | 0.013 |

| DSHUSD | Dash Coin vs United States Dollar CFD | 1.241 |

| EOSUSD | EOS vs United States Dollar CFD | 0.064 |

| ETHUSD | Ethereum vs United States Dollar CFD | 11.605 |

| GLMUSD | Moonbeam vs US Dollar | 0.01149 |

| KSMUSD | Kusama vs US Dollar | 0.253 |

| LNKUSD | Chainlink vs United States Dollar CFD | 0.02 |

| LTCUSD | Lite Coin vs United States Dollar CFD | 1.597 |

| LUNUSD | Luna vs US Dollar | 0.0049 |

| MTCUSD | Polygon vs US Dollar | 0.006 |

| SOLUSD | Solana vs US Dollar | 0.0934 |

| UNIUSD | Uniswap vs United States Dollar CFD | 0.064 |

| XLMUSD | Stellar vs United States Dollar CFD | 0 |

| XRPUSD | Ripple vs United States Dollar CFD | 0.02 |

| XTZUSD | Tezos vs United States Dollar CFD | 0.026 |

Bonds

Bonds are available for trading in the following nine commodities.

| Products | Description | Average Spread |

|---|---|---|

| EURBOBL | Euro Bobl | 0.01 |

| EURBUND | Euro Bund | 0.011 |

| EURSCHA | Euro Schatz | 0.01 |

| ITBTP10Y | BTP Italian Bonds | 0.02 |

| JGB10Y | Japanese 10 YR | 0.034 |

| UKGB | UK Long Gilt | 0.012 |

| UST05Y | US 5 YR T-Note | 0.014 |

| UST10Y | US 10 YR T-Note | 0.031 |

| UST30Y | US T-Bond (30 year) | 0.031 |

Stocks

There are more than 2,000 stock commodities available for trading, including popular stocks not only in the United States but also in Japan, Europe, and Australia.

Detailed information on tradable stocks and trading hours can be confirmed on the IC Markets product page.

High Trade Execution Rates

The efficiency of the data center is easily overlooked in the light of favorable trading specifications, yet it is a very important aspect for individual investors in China.

At IC Markets, trade clearing and slippage are rare, and the extremely fast order execution of less than 0.04 seconds on average is highly praised.

This provides a more convenient trading environment for EA users and scalpers.

Rich Trading Platform

IC Markets supports a wide range of devices, so you can trade on your cell phone or tablet without any time or venue restrictions.

The trading platforms support MT4, MT5 and cTrader.

MT4 is characterized by its versatility and excellent technical analysis, while MT5, which is based on MT4, enhances fast trading.

Widely supported by European traders, cTrader is a platform developed specifically for ECNs and has always been a powerful tool for traders seeking a low spread floating environment for high speed trading.

No Restrictions on Trading Techniques, Automated Trading (EA)

IC Markets does not have any restrictions on scalping and arbitrage trading.

In addition, it is possible to use the greatest advantage of MT4, automatic trading (EA) and copy trading, with a high degree of freedom.

Comprehensive Funds Management System

In terms of fund management, IC Markets distinguishes between client funds and business funds, which are managed by trust accounts with Westpac Bank and National Australia Bank.

The official website also clearly states that customer funds will not be used for business purposes and promises to strictly manage customer funds.

Even in the unfortunate event of unforeseen circumstances such as business bankruptcy, IC Markets has added an insurance policy of up to 1 million dollars per person, so the fund management system can be said to be very safe.

About IC Markets Deposit and Withdrawal

When choosing a forex broker, it is very important for traders to choose whether or not to provide a variety of deposit and withdrawal methods, and IC Markets has a variety of channels for traders to choose from in this regard.

Providing domestic remittances and cryptocurrencies for deposits is a major advantage of IC Markets.

Deposit Methods

IC Markets supports the following deposit methods.

| Deposit Method | Support Currency | Handling Fee | Payment Time |

|---|---|---|---|

| Domestic Bank Transfer | USD | None | 5~20 minutes |

| International Bank Transfer | CAD、EUR、CHF、GBP、USD | None※ | 2~5 working days |

| Cryptocurrency | USDT | None | Immediately |

※Additional handling fee will be charged

The withdrawal process can be found in the link below.

Withdrawal Methods

For withdrawal, the following channels are available.

However, it is important to note that withdrawal requests will be accepted on the next business day when the withdrawal request time has passed 0:00 AEST.

| Withdrawal Methods | Support Currency | Handling Fee | Deposit Time |

|---|---|---|---|

| Domestic Bank Transfer | USD | None | 5~20 minutes |

| International Bank Transfer | CAD、EUR、CHF、GBP、USD | None※ | 2~5 working days |

| Cryptocurrency | USDT | None | Immediately |

※Additional handling fee will be charged

The withdrawal process can be found in the link below.

Introduction of Negative Balance Protection System

IC Markets employs a negative balance protection system, so that even if a loss exceeding the margin is incurred, no additional margin will be requested.

The Negative Balance Protection System has not been implemented by domestic forex brokers, so it is arguably one of the biggest advantages of using an overseas forex broker.

About IC Markets Customer Service

IC Markets offers 24-hour customer service by phone, e-mail and instant text messaging.

Generally speaking, there may not be many opportunities to contact customer service, but traders still need to be aware of this situation in advance.

A well-established brokerage recommended for traders seeking peace of mind.

IC Markets has a wealth of trading products and competitive spreads, which is part of its appeal.

However, more importantly, IC Markets has excellent trade execution capability and safe fund management, which is the stability accumulated from operating overseas markets for a long time, and this may also be the biggest advantage of IC Markets.

In the future, IC Markets will continue to improve its customer support and trading conditions to meet the needs of its Chinese-speaking customers, and we believe this is something to look forward to.

In order to experience the convenience and advantages of an account, we recommend that you consider opening an account with a small amount of capital.

IC Markets, as a veteran platform, enjoys a good reputation for providing a safe and reliable trading platform.

The richness of trading commodities, spreads starting from as low as 0.0 pips, coupled with a stable and non-slippery trading environment as well as a perfect fund management system, are all great attractions of IC Markets.